Coworking Space Growth

Number of Spaces in Osaka

+40% NLA since 2019 highlights robust sector growth.

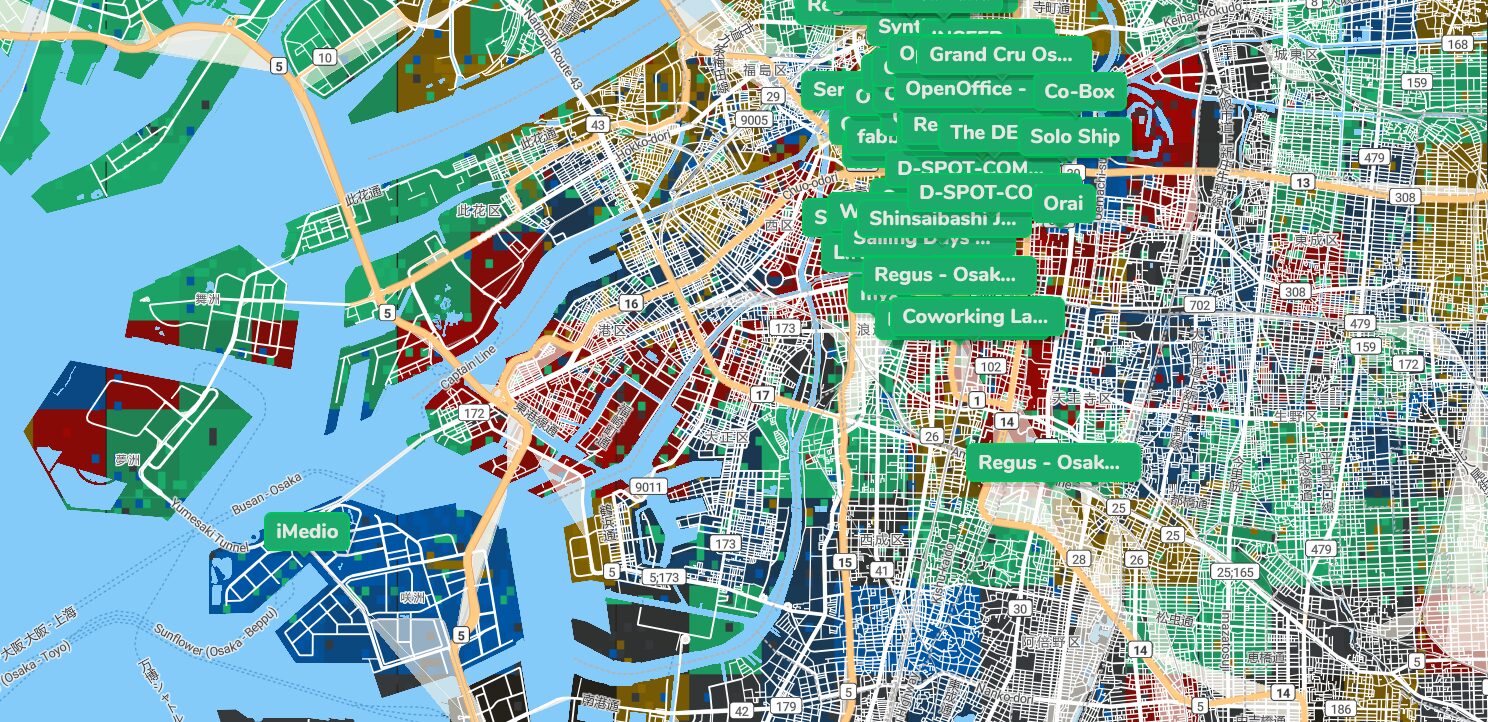

Osaka’s Booming Flexible Workspace Scene — Osaka is fast emerging as a hotspot for flexible office space and coworking trends, driven by surging demand from startups, multinationals, and a push towards new ways of working. The upcoming Expo 2025 on Yumeshima Island has put a spotlight on the Osaka Bay area – sparking infrastructure upgrades and business growth that make this guide especially timely.

In this comprehensive overview, we’ll delve into Osaka’s coworking and office rental trends,

covering everything from market stats and emerging districts to amenities, pricing,

and support programs.

Whether you’re a digital nomad seeking a coworking space or an enterprise scouting offices, use this data-driven guide to navigate Osaka’s evolving office landscape.

Osaka is Japan’s second-largest business hub, and its office market is on a dynamic growth trajectory. While Tokyo still commands over half of Japan’s office market by value, Osaka is projected to have the fastest growth rate – about 1.81% CAGR through 2030. This robust outlook highlights Osaka’s rising importance for office space investment.

The flexible workspace sector in particular has expanded rapidly: in central Osaka (Umeda, Honmachi, Namba, etc.), coworking and serviced offices now occupy roughly 58,000 m² of floor space, up 40% since 2019. As of early 2025, Osaka City hosts an estimated ~209 flexible office locations (coworking spaces, serviced offices, etc.), with about 356 across the broader Kansai region.

Despite this boom, there is still huge room for growth. Flexible offices account for just a bit over 1% of Osaka’s Grade A office stock – a low penetration even by national standards. For context, Tokyo has over 2,000 flex offices, dwarfing Osaka’s count.

The “flight to quality” trend is evident: nearly half of Osaka’s flex workspaces are located in prime office buildings downtown, indicating that many users prefer high-grade spaces with top amenities.

The rest of the city’s coworking supply is scattered in smaller offices, which may face more challenges in attracting clients.

Overall, Osaka’s flexible office market is vibrant but under-saturated,

signaling plenty of upside as companies large and small embrace hybrid work and satellite offices here.

From a traditional office perspective, Osaka’s leasing market has been active as well. A record wave of new office supply (~90,000 tsubo of floor space) opened in 2024 – including landmark projects like Grand Green Osaka in Umeda – and was met with strong tenant demand. Prime office vacancy remains low (around 3.9%) and rents have even risen modestly.

This healthy absorption of new offices, combined with major upcoming events

(Expo 2025, an integrated resort opening 2029),

gives Osaka a bright outlook. In short, Osaka’s office sector is growing in both scale and flexibility,

making it an exciting time to establish or expand operations here.

A comparative look at coworking and office market trends.

Number of Spaces in Osaka

+40% NLA since 2019 highlights robust sector growth.

Osaka vs. Tokyo (Q1 2025)

Osaka’s lower vacancy suggests a tighter, high-demand market.

Relative Cost Advantage

Osaka averages ~85% of Tokyo’s rent levels.

Charting the milestones and economic ripple effects driving demand in the office market.

The Osaka Metro Chuo Line extension provides direct, high-capacity rail access to the Expo site—dramatically improving connectivity to the bay area and priming future development.

A 184-day global event draws businesses and tourists, creating immediate demand for short-term office space, meeting facilities, and support services—putting Osaka on the world stage.

The focus shifts to legacy: repurposing the site and leveraging new transport. This period is pivotal for attracting permanent corporate tenants and R&D facilities.

The MGM Osaka resort on Yumeshima establishes a lasting hub for tourism and business—sustaining demand for offices and related services for years to come.

Osaka offers a rich variety of coworking hubs, from global networks to creative local spaces. Most are concentrated in central business districts like Umeda, Honmachi, and Namba. Both international giants and domestic leaders are shaping the city’s vibrant flex workspace scene.

International operators like WeWork and Regus are prominent in Osaka’s prime office towers.

Regus and its sister brands Spaces, HQ, and Signature offer everything from private suites to virtual office services.

Signature’s premium floor in the Osaka Umeda Twin Tower South (opened 2024) and WeWork’s tech-forward hubs on Midosuji make them popular with startups, global firms, and event organizers. Servcorp adds a touch of prestige for executives seeking top-tier amenities in 5-star buildings.

Major Japanese landlords are getting in on the coworking trend. Brands like Workstyling (Mitsui Fudosan) in Umeda and Honmachi, and H¹O (Nomura Real Estate) in central Osaka, now serve a range of corporate tenants.

Even conservative landlords are launching flex space to meet surging demand,

including Tokyu Fudosan’s Business-Airport chain, which delivers premium design and concierge service.

Osaka’s indie coworking spaces add real character to the ecosystem. The DECK near Honmachi is famed for its makerspace and startup events. Osakan Space (Shinsaibashi) is beloved by freelancers and digital nomads.

Newer options like FUTURO offer kitchen, showers, and hip lounges.

For a more corporate vibe, SYNTH and Business-Airport have entered the market with sleek decor and business services.

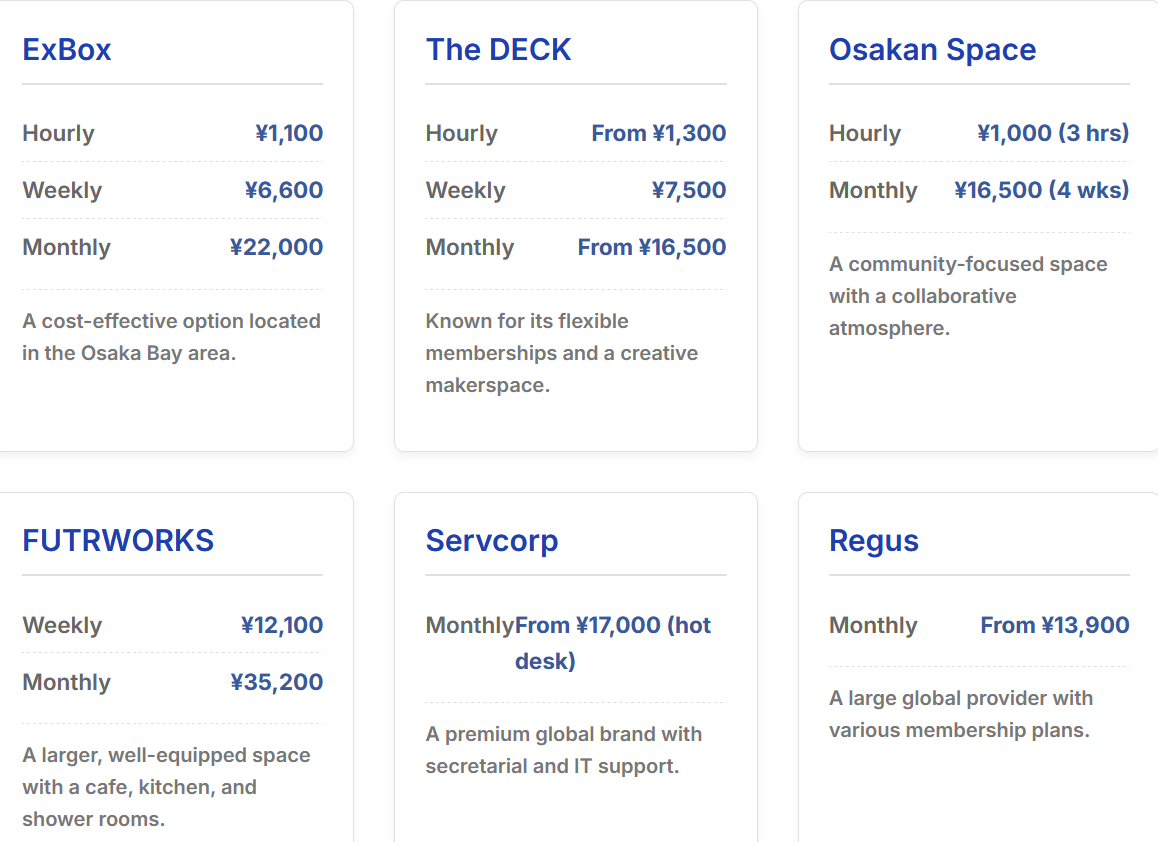

Osaka’s coworking price points are generally competitive compared to Tokyo. Options range from flexible drop-in passes to premium memberships, with value-added services that make it easy to get started.

The World Expo 2025 is a massive catalyst for Osaka’s real estate and office market, with immediate and long-term effects on demand, infrastructure, and business location strategy.

Hosting Expo 2025 elevates Osaka’s profile as a forward-looking, innovation-friendly city. The Expo’s theme, “Designing Future Society for Our Lives,” draws global attention to sectors like IoT, AI, and biotech.

Startups & R&D: Many foreign firms are experiencing Osaka first-hand and may open startup offices or labs here post-Expo. Government organizations like JETRO and O-BIC are actively recruiting these companies with tours and seminars during the event.

The Integrated Resort (IR) project, opening in 2029, will include casinos, hotels, and convention facilities – keeping visitors (and demand for offices) high well after 2025.

Innovation Island? Some Expo pavilions/land could be repurposed for a tech business park or research campus. This could create a lasting innovation hub on Yumeshima.

Coworking in Osaka offers radical flexibility and a low barrier to entry—no long commitments, no key money, no agent fees. Perfect for global entrepreneurs, startups, and agile teams.

Modern Osaka coworking spaces and serviced offices deliver global-standard amenities, ultra-flexible plans, and a thriving community vibe — at rates typically below Tokyo.

Osaka coworking spaces make it simple: skip the paperwork, skip the multi-month deposits, and skip the “key money.” Scale up or down as your business needs change — all at a fraction of the commitment of a traditional lease.

| Provider | 24/7 Access | Monthly (¥) | English Staff | Perks |

|---|---|---|---|---|

| WeWork | ✔️ | ~38,000 | ✔️ | Events, global network |

| Regus | ✔️/✖️ | 13,900+ | ✔️ | Virtual office, premium buildings |

| ExBox | ✔️ | 22,000 | ✔️ | Expo site, English signage |

| The DECK | ✖️ | 16,500 | ◯ | Startup events, makerspace |

| Servcorp | ✔️ | 17,000+ | ✔️ | Prestige, full service |

Osaka’s office landscape has been transformed by remote and hybrid work — with uniquely Japanese twists. Even traditional firms now see the benefits of flexibility, resilience, and cost-saving in new workspace models.

Hybrid work isn’t just a pandemic blip—it’s reshaping how companies recruit, operate, and compete for talent in Osaka.

From business registration to startup visas, knowing the rules (and avoiding hidden costs) is key to a smooth Osaka office setup.

Osaka’s flex-space model is designed to lower barriers—yet knowing the basics on taxes, labor rules, and incentives will keep your setup smooth and compliant.

Osaka is rapidly evolving into a welcome hub for foreign startups, powered by Expo 2025 momentum, government-backed incentives, and a thriving innovation network.

Osaka is rolling out soft landing programs, networking opportunities, and targeted incentives to help international entrepreneurs quickly integrate into the city’s business ecosystem.

Osaka’s coworking and office rental landscape in 2025 is dynamic and full of opportunity. Hybrid work, new infrastructure, and the Osaka Bay renaissance are reshaping demand across the city. The bottom line: growth, flexibility, and cost advantages that few Asian cities match right now.

Osaka is on the rise — blending a rich commerce tradition with innovation and international flair. Plug into its coworking network and make smart, data-backed real estate choices. We hope to see you working with an Osaka Bay sunset soon! 🌅

Robert Paul Tarczynski

Project Manager Associate , Marketing specialist for ExBox

Enjoyed this article? Share it:

Share on LinkedIn